Investing in Gold Over Bitcoin: A Major Misstep, Says Mark Cuban

Written on

The Case Against Gold

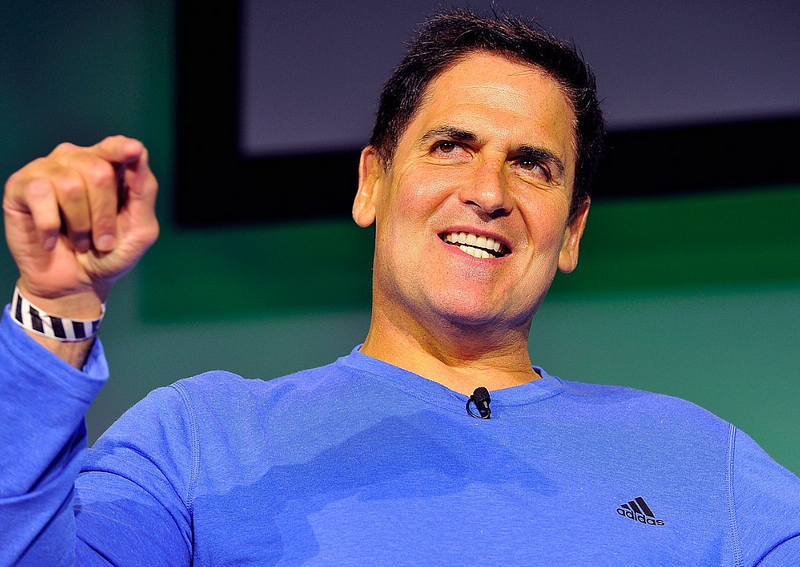

Mark Cuban, the self-made billionaire and owner of the Dallas Mavericks, has made headlines with his strong opinions on investing. He boldly asserts that if you're investing in gold, "you’re dumb as f***." In his view, gold is more akin to a belief system than a sound financial investment.

Cuban rose to fame through his appearances on the reality show Shark Tank, where he, along with other investors, evaluates pitches from aspiring entrepreneurs. His wealth primarily stems from the sale of Broadcast.com to Yahoo for $5.7 billion in 1999, a deal that has since been criticized as one of the worst tech acquisitions.

The Debate: Gold vs. Bitcoin

The ongoing debate regarding the better store of value—gold or Bitcoin—continues to engage both cryptocurrency advocates and traditional investors. Historically, gold has been viewed as a reliable asset for wealth preservation, while Bitcoin has emerged as a popular alternative due to its limited supply and decentralized framework.

Cuban is a passionate supporter of Bitcoin, claiming it has the potential to be a more stable and secure option than gold. He humorously stated in a recent interview that he hopes Bitcoin's price drops so he can buy more. He then proceeded to criticize gold investors, bluntly calling them "dumb as f***."

Cuban emphasizes:

> "If you have Gold, you’re dumb as f***. Gold isn’t a hedge against anything. It’s a stored value; you don’t own the physical Gold."

He argues that owning gold equates to possessing only a digital representation of value, not the actual gold bar. In a hypothetical crisis, he believes that holding gold could put you in danger, as people would fight over it.

The Risks of Gold Investment

While many people may prefer gold for its historical reliability and perceived stability, Cuban argues that this mindset is misguided. Ultimately, the choice between gold and Bitcoin as a store of value is a matter of personal belief and risk tolerance.

Cuban insists that Bitcoin, despite not being a physical commodity like gold or silver, possesses inherent value due to its utility and decentralized nature. Unlike traditional currencies, Bitcoin is not subject to manipulation by governments or financial institutions, making it a valuable medium for transactions. He points out that Bitcoin's limited supply is a crucial element contributing to its long-term value.

Cuban's support for Bitcoin has made him a significant figure within the cryptocurrency community, where he advocates for its potential as a future financial asset. He regards gold as merely a "religion" and a "collectable," rather than a viable investment.

In contrast to gold, which continues to be mined without limits, Cuban highlights that Bitcoin has a finite supply. He also points out that gold is not a practical alternative currency, as evidenced by its absence in everyday transactions in places like Puerto Rico.

Cuban’s Distaste for Gold

Cuban’s disdain for gold is evident:

> "I hate Gold. I see Gold and Bitcoin as being the same thing. The value is based on supply and demand. The good news about Bitcoin is there’s a finite supply that will ever be created, and the bad news about Gold is they’ll keep on mining more."

He believes that while gold can be useful for saving, it is more of a belief system than a genuine investment opportunity.

Final Thoughts

It’s evident that Mark Cuban is a staunch advocate for Bitcoin as a store of value and investment. He believes that Bitcoin’s algorithmic scarcity and limited supply make it a more appealing choice compared to gold, which he dismisses as a mere "religion."

Cuban also sees Bitcoin as having a significant advantage over other cryptocurrencies due to its status as the leading digital asset with minimal competition. As less reputable blockchains falter, Bitcoin stands out as a safer and more conservative investment for those looking to preserve their wealth.

However, it's important to note that not everyone aligns with Cuban's optimistic perspective on Bitcoin. Critics often highlight Bitcoin's volatility and the absence of regulatory oversight as significant risks. Evaluating both sides of the argument is crucial before making any investment decisions.

If you’re interested in learning more about the future of Web3, consider becoming a member. Your subscription helps support the writers you appreciate, and I’ll receive a small commission if you sign up using my link.

This article is intended for informational purposes only and should not be regarded as financial, tax, or legal advice. Consulting a financial professional before making substantial financial decisions is always a prudent choice.

The first video features Mark Cuban articulating his stance on gold investment, emphasizing his belief that it's a poor choice.

In the second video, Mark Cuban continues his critique, asserting that both gold and Bitcoin lack value as investments but highlights Bitcoin's advantages.