Bitcoin: The Investment Opportunity of a Lifetime

Written on

Chapter 1: The Rise of Bitcoin

Bitcoin has been heralded as the investment of our time, but it’s crucial to adhere to classic investing principles.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Trust in Algorithms Over Traditional Banking

In the eyes of many, traditional banking systems pose risks, leading them to seek alternatives like Bitcoin. Anthony Pompliano, a well-known advocate for Bitcoin, suggests that more individuals will come to rely on an algorithm for monetary policy rather than human decisions. This shift occurs as people recognize the instability inherent in traditional currencies and the banking system.

Many individuals invest modestly in Bitcoin—typically between 1% and 5% of their portfolios—as a safeguard against potential failures in conventional finance. Remarkably, over 150 million people around the globe have embraced this digital asset since its inception just 15 years ago.

Section 1.2: Long-Term Investment Strategies

Pompliano emphasizes that those who commit to holding Bitcoin for the long run are likely to reap the rewards, akin to early investors in internet stocks. A crucial investment strategy is maintaining a long-term perspective; investing is more about endurance than speed. Despite Bitcoin's notorious volatility—often experiencing price drops of 50% to 75%—those who adhere to classic investing principles typically succeed.

Chapter 2: Avoiding Emotional Investing

This video features Anthony Pompliano discussing why Bitcoin is likened to "gold with wings," highlighting its potential as a transformative asset.

Section 2.1: The Value of Dollar-Cost Averaging

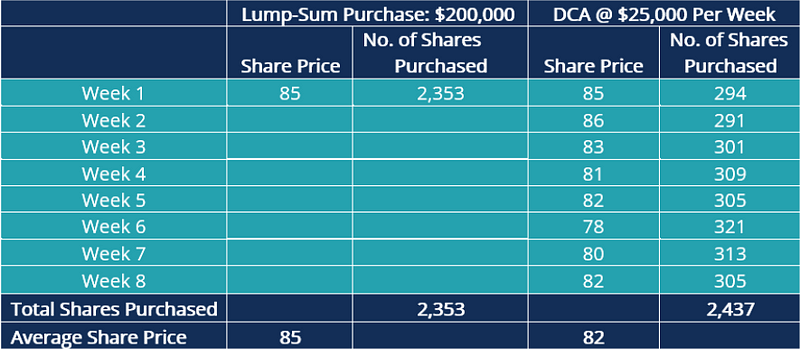

Bitcoin's inherent volatility makes strategies like Dollar-Cost Averaging (DCA) essential. This approach involves investing a fixed sum at regular intervals, regardless of market conditions, which can mitigate the impact of price fluctuations.

DCA may not consistently outperform a one-time lump sum investment, but it offers several advantages:

- Reduces risk through smaller transactions.

- Facilitates purchases during price dips.

- Helps navigate market downturns.

- Functions as a disciplined savings method.

- Minimizes the risks of poor timing.

The core benefit of DCA lies in the ability to acquire more assets when prices are low.

Section 2.2: Emotions and Investment Performance

Pompliano argues against short-term trading, asserting that a long-term view is vital for emotional stability. Many investors falter due to impulsive reactions to market changes, resulting in unnecessary transaction costs and diminished returns.

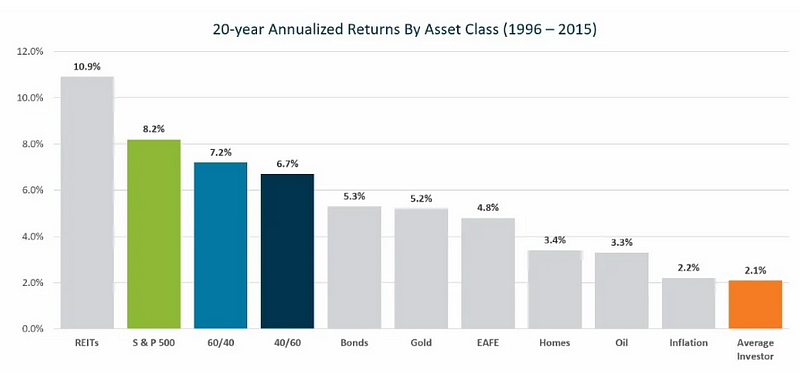

Statistics reveal that while the S&P 500 averaged an 8.2% return over two decades, typical investors who frequently bought and sold earned only 2.1%, which barely surpassed inflation.

Final Thoughts

By late 2022, 71% of Bitcoin had not changed hands for over six months, indicating that longer holding periods correlate with reduced likelihood of selling. As demand rises and supply diminishes, Bitcoin’s value can potentially skyrocket.

Pompliano's insights reveal that Bitcoin represents an unprecedented investment opportunity for everyday individuals, enabling them to participate in a market that was once restricted to accredited investors. While novices may stumble, applying enduring principles such as maintaining a long-term outlook and managing emotions is vital for success.

Join my Substack today to receive daily insights from leading experts in Crypto, Business, Finance, and Technology—all for free.

This article is intended solely for informational purposes and should not be construed as financial, tax, or legal advice. It is advisable to consult a financial professional before making significant financial decisions.

In this video, market experts discuss the current volatility of Bitcoin and stocks, providing insights into the ongoing trends and what they mean for investors.